ACI EUROPE has released its traffic report for December, Q4, H2 and Full Year 2018. It is the only air transport report that includes all types of airline passenger flights to, from and within Europe: full service, low cost, charter and others.

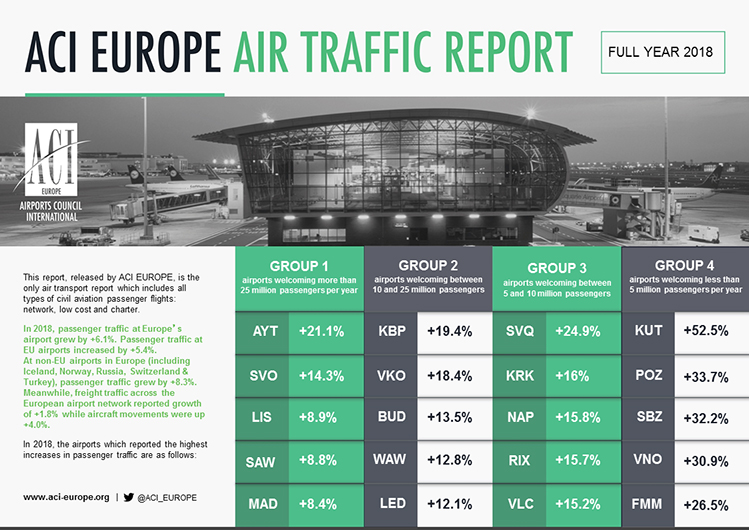

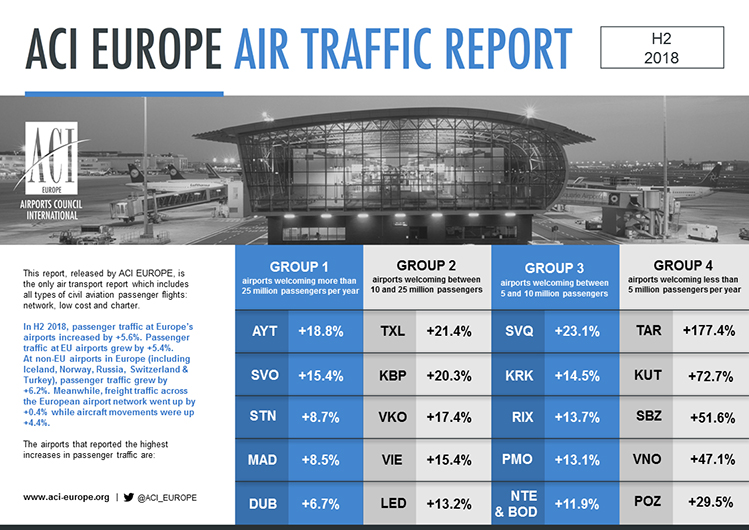

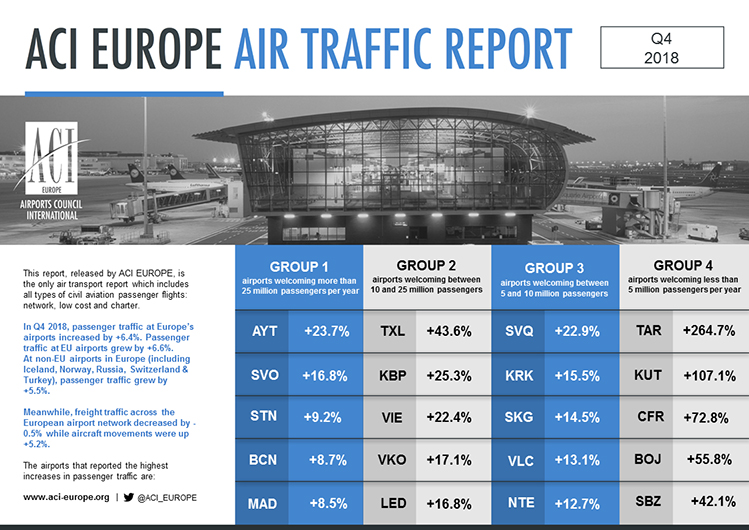

Passenger traffic across the European airport network grew by +6.1% last year, bringing the total number of passengers using Europe’s airports to a new record of 2.34 billion. While growth somehow moderated in 2018 when compared to the exceptional performance of 2017 (+8.5%), it remained very dynamic – especially considering underlying economic trends and geopolitical tensions. Continued airline capacity expansion played a major role, as aircraft movements grew by +4% – even faster than in 2017 (+3.8%).

“Once again, passenger traffic has shown remarkable resilience in 2018, with Europe’s airports welcoming an additional 136.6 million passengers,” comments Olivier Jankovec, Director General, ACI EUROPE. “This means that in just five years, passenger traffic has expanded by more than a third (36%) – with more than 629 million additional passengers – of which 445 million were in the EU alone. Managing such growth has been quite a challenge and the strain on airport facilities and staff is real. Capacity and quality are now major issues for an increasing number of airports across Europe. This of course requires investment but also greater operational efficiency – through effective airport-ATM integration and alignment with all other stakeholders.”

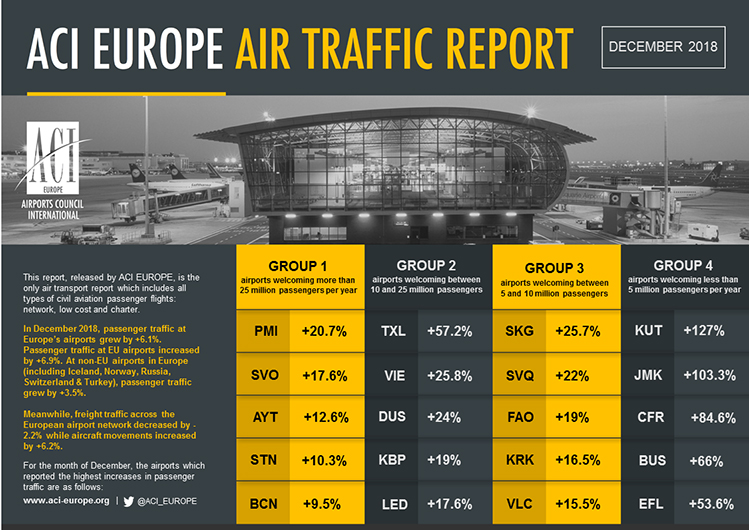

Passenger traffic at EU airports posted an average increase of +5.4% in 2018 (compared with +7.7% in 2017) – with ATM disruptions, airline strikes and consolidation limiting gains in several markets up to the summer. Since then growth has been on an upward trend, with December closing at nearly +7%.

Airports in the Eastern and Southern parts of the EU achieved the best performances, along with those in Austria and Luxembourg. Accordingly, the following capital and primary airports posted double-digit growth: Vilnius (+30.9%), Bratislava (+18.1%), Riga (+15.7%), Budapest (+13.5%), Tallinn (+13.4%), Malta (+13.2%), Warsaw-Chopin (+12.8%), Milan-Malpensa (+11.5%), Luxembourg (+12.2%), Athens (+11.2%), Vienna (+10.8%) and Helsinki (+10.4%). Conversely, the weakest results came from airports in Sweden (where passenger traffic stalled in the wake of the introduction of an aviation tax) and the UK (a reflection of mounting Brexit fears on the economy).

Meanwhile, non-EU airports saw passenger traffic expand by +8.3% (compared to +7.7% in 2017). However, unlike in the EU market, growth has followed a downward trend throughout the year, from an impressive +14.6% in January to +3.5% in December. This was mainly due to domestic demand at Turkish airports being affected by the country’s economic woes (total passenger traffic growth at Turkish airports stood at +0.9% in Q4), weaker demand at Norwegian airports and growth coming to halt at Icelandic airports towards the end of the year (-0.1% in December).

Conversely, airports in Russia, Belarus, Ukraine, Georgia, Israel, Albania, Northern Macedonia, Montenegro and Bosnia Herzegovina grew above the non-EU average. The best individual airport performances came from Kutaisi (+52.5%), Antalya (+21.1%), Tbilisi (+20.4%), Kiev (+19.4%), Kharkiv (+19.3%), Bodrum (+18.8%), Rostov (+18.8%), Moscow-Vnukovo (+18.4%), Skopje (+15.5%), Pristina (+14.7%) and Moscow-Sheremetevo (+14.3%).

The majors (Europe’s top 5 busiest airports) registered +4.8% growth in passenger traffic in 2018, down from +5.5% the preceding year. This lower performance compared to the European average reflected mainly capacity limitations, intensifying hub competition and hub by-pass developments, as well as airline strikes. Still, the majors collectively welcomed 16.5 million additional passengers.

Frankfurt achieved the highest growth among the league (+7.8% – fourth position with 69.51 million passengers), on the back of a successful traffic diversification strategy. Istanbul-Atatürk posted the second-best performance (+6.4% – fifth position with 68.19 million passengers) but saw passenger traffic slowing down significantly towards the end of the year (only +1% in Q4). The Turkish hub was followed by Paris-CDG (+4% – second position with 72.22 million passengers), where strikes at the home-based network carrier took their toll. Meanwhile, capacity constraints more than halved growth at Amsterdam-Schiphol (+3.7% compared to +7.7% in 2017 – third position with 71.05 million passengers) and also limited gains at London-Heathrow (+2.7%) which remained the busiest airport in Europe, with 80.12 million passengers.

While performances also varied significantly between regional airports, many posted impressive passenger traffic gains in 2018 – a reflection of their agility and success in attracting airlines and developing air connectivity. These included Poznan (+33.7%), Sibiu (+32.2%), Memmingerberg (+26.5%), Seville (+24.9%), Kefallinia (+21.6%), Mikonos (+17.1%), Genoa (+16.7%), Krakow (+16%), Varna (+15.9%), Naples (+15.8%), Linz (+15.7%), Ostend (+15.7%), Valencia (+15.2%), Palermo (+14.8%), Toulon (+13%) and Nantes (+12.6%). However, smaller regional airports (below five million passengers per year) underperformed the European average, growing by +5.1%.

Want more access to the latest airport traffic data? ACI EUROPE has developed a dedicated app providing just that. The app gives you all the usual key figures, but also enables you to make customised comparison tables and graphs that can be downloaded and shared via email or social media. The app is available for iOS, Android and as a web app. To find out more, go to www.aci-europe.org/trafficapp