By Ralph Anker, editor, anna.aero

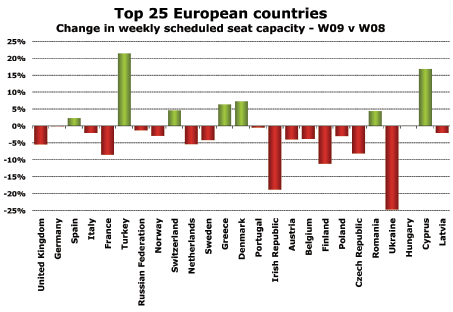

Eight of the top 25 European countries (as measured by weekly departing seat capacity) report year-on-year growth, although only one of the ‘big 5′ is reporting an increase in seat capacity. That country is Spain where an almost 6% growth in seat capacity at Madrid Barajas is helping to generate overall capacity growth of just over 2%. Turkey’s impressive growth is likely to be somewhat overstated as OAG data for 2008 did not include most of the Pegasus network as well as some other local airlines. On weekly seat capacity Pegasus currently ranks inside the top 30 of European airlines.

Denmark, Greece and Switzerland all expect growth this year, each for their own reasons. The ongoing recovery of Lufthansa-controlled Swiss continues to help the Swiss market, while despite the downsizing at the new Olympic Air, impressive growth by local rivals Aegean and Athens Airways has helped the Greek market to report modest growth. In Denmark, the surge of interest from carriers (such as Cimber, Norwegian and Transavia.com) to fill in the hole left by the demise of Sterling last October has helped the Danish market to generate a 7% growth in capacity. Of course, an increase in capacity does not automatically result in an increase in demand, but it is a powerful indicator of where airlines believe growth is most likely to be viable.

Source: OAG Max Online for w/c 9 November 2009 and w/c 10 November 2008.

At the other end of the scale both France and the UK are experiencing capacity cuts of between 5% and 10%.

Both main Paris airports are down between 7% and 10% in terms of seat capacity this November, which has a major influence on the French market as a whole. In the UK London Gatwick has recovered some of the ground lost last year thanks to more new easyJet services and the development of a base by Irish flag-carrier Aer Lingus. However, nearly all other major UK airports are down between 5% and 15%, the notable exception being Liverpool which is up 13%.

Capacity at airports in the Irish Republic is down almost 20% which would appear to be as a result of airlines (in particular Ryanair) cutting capacity in response to the imposition earlier this year of a €10 tax on air travel. Not renowned for taking such impacts in its stride, Ryanair has simply moved capacity elsewhere in its pan-European network leaving the Irish authorities to figure out whether the gain in revenue from taxation has been more than negated by the reduction in inbound tourism revenues. Other countries such as Denmark and the Netherlands have already reversed their decisions to introduce taxes on air travel. How long before Ireland does the same?

Among the Central European countries only Romania appears to still be showing signs of significant growth.

The Polish ‘bubble’ created by significant worker migration to the UK and Ireland has long since burst leaving the country’s airports to come to terms with minimal if any growth after several boom years.

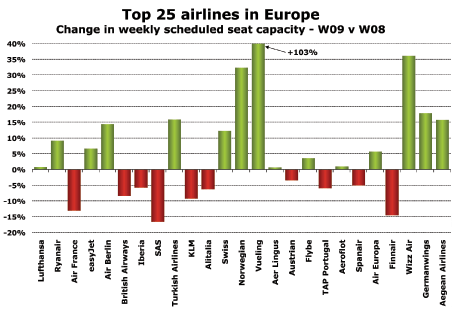

LCCs main source of airline growth (again)

A detailed look at scheduled capacity by airline reveals that once again it is the low-cost carriers who are managing to grow during a period of recession. While the majority of flag-carriers continue to cut capacity (Lufthansa, Swiss and Turkish Airlines are notable exceptions), easyJet and Ryanair continue to grow organically. The growth of airberlin can be attributed to its recent takeover of much of TUIfly’s ‘city’ as opposed to ‘leisure’ network, while Norwegian’s growth is helped by the completed integration of its Swedish subsidiary. Vueling’s doubling in size is easily explained by its recent merger with clickair.

Other carriers reporting significant year-on-year growth include Aegean, germanwings and Wizz Air. Finnair and SAS report the greatest capacity cutbacks indicating that the global recession has had a significant impact on traditional airlines in the Nordic countries.

Source: OAG Max Online for w/c 9 November 2009 and w/c 10 November 2008.

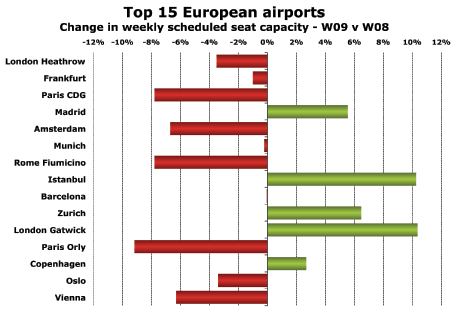

More chances to catch some winter sunshine?

A comparison of the leading airports across Europe reveals that five of the top 15 are offering more capacity this November than last, with two further airports almost unchanged. Five airports show a capacity drop of more than 5% (both Paris airports, Amsterdam, Rome Fiumicino and Vienna). The last two are suffering due to the problems of their national carriers, while Vienna has also lost capacity due to the eventual (but inevitable) demise of SkyEurope.

A detailed look at scheduled capacity by airline reveals that once again it is the low-cost carriers who are managing to grow during a period of recession. While the majority of flag-carriers continue to cut capacity (Lufthansa, Swiss and Turkish Airlines are notable exceptions), easyJet and Ryanair continue to grow organically.

One region that is witnessing lots of new route activity this winter is the Canary Islands with several low-cost carriers (notably Ryanair) starting many, low-frequency services to Arrecife / Lanzarote, Las Palmas / Gran Canaria and Tenerife. After an indifferent summer across most of Northern Europe these services offer customers the chance to embrace some warm weather during the traditionally colder winter months.

Other airports that can look forward to this winter being busier than last include several smaller, secondary airports where Ryanair has a base (such as Brussels Charleroi, Paris Beauvais, Stockholm Skavsta and Weeze) as well as ambitious, proactive airports such as Moscow Domodedovo and Istanbul Sabiha Gokcen.

Considering the economic environment surprisingly few significant airlines have actually failed during 2009. FlyLAL, MyAir and SkyEurope were probably the most high profile but are unlikely to be the last. The appetite for consolidation and new partnerships looks likely to continue as airlines fight to stay afloat. According to many the start of an actual recovery in air travel demand is now unlikely to appear before 2011.

Source: OAG Max Online for w/c 9 November 2009 and w/c 10 November 2008.

Read more airline news at anna.aero.