While Domodedovo’s total passenger flow in January saw a 5% increase on the same period in 2007, the biggest growth was seen in international traffic – up 11.9% in 2008 year-on-year. East Line Group’s strategy to drive international growth is reflected in the master plan to 2020. Construction of the new Terminal 2 has begun this year, which will be dedicated to serving only international flights.

Terminal 2 is due to open in 2015, with the final phase of the project constructed “behind the scenes” to 2019.

The project is essential if Domodedovo is to maintain growth levels, explained Burkard. “We are aiming at growing international traffic and we still need capacity to grow here.”

Domodedovo handled 20.4 million passengers last year and while the current economic slowdown is having a direct impact on throughput into 2009, Domodedovo expects to recover with increased frequency on international routes. “We won’t handle much less traffic this year because our international scheduled traffic is growing,” said Burkard.

The third and final phase of the Terminal 2 project will result in 270,000sqm of terminal floorspace, 19 air bridges and an annual passenger capacity of 8-9 million.

United Airlines will be among four carriers to begin new services from Domodedovo this year, adding to the 207 destinations the airport already serves.

In order to meet the airport’s long-term capacity needs, construction and expansion of Terminal 2 will be in three phases and will initially provide capacity for four and five million passengers, with completion expected in 2019.

Domodedovo’s partner airlines serve 84 destinations exclusively from the airport. Burkard: “The big question is which traffic will depart and land from which airport. We have more scheduled traffic than Sheremetyevo, but they now have Aeroflot.”

Terminal 1 extension

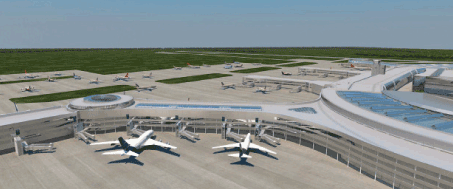

In the first phase of expansion, the existing Terminal 1 will be enlarged with a separate finger. The new Terminal 2 will be constructed as part of the existing facility, with eight air bridges, over a total space of 50,000sqm to serve international flights.

Stage 2 works include the extension of the finger towards the apron area and a further expansion of the floor space to 145,000sqm, to include a new check-in area, 70 check-in desks, five baggage carousels and a new automated sorting system to connect with the existing Terminal 1. At this stage the terminal will be able to accommodate 8-9 million annual passengers.

Terminal 2 is due to open in 2015, with the final phase constructed “behind the scenes”. The scope of the expansion is designed so that passengers will not realise construction is still going ahead, said Burkard. The project will involve a further extension of the finger and the number of air bridges will be increased to 19. After its completion date in 2019, the terminal will be spread over 270,000sqm, with an annual capacity of 8-9 million passengers.

The new Terminal 2 has been designed to dramatically reduce the service time per passenger. Levels one and two will be split to serve arrivals and departures. There will also be a special handling area for VIP and first/business class passengers on the third floor, as well as a dedicated area for transfer passengers.

A new parking facility is also under construction for Terminal 2, with 6,000 multi-level parking spaces, VIP parking, conference areas and a new hotel, all built into a separate complex. Terminal 2 will be connected by bridge to the hotel in 2019.

Once capacity for international traffic has been met, a third terminal is proposed under the master plan, to serve domestic flights only. “We expect to start construction in 2015, but if the market picks up it could be sooner,” said Burkard.

Cargo village

“Developing our cargo operations is another main focus for us,” said Burkard. East Line Group will take advantage of the 240,000 hectares of land it owns around the airport to construct a cargo village and Burkard has great optimism for the future of Domodedovo’s cargo operations. “We will grow in cargo – we are the only airport in Moscow with the space to grow and we are putting in a lot of time and resources to become an undisputed leader in cargo operations in the Moscow aviation hub.”

Two plots of land have been issued for the first and second phases of construction, which have been already been approved. The works will comprise 50,000sqm of warehouse space, to include two cargo terminals of 10,725sqm and 14,800sqm, taxiways, an apron and ramp, two-storey office buildings with an area of 9,600sqm, landside parking and a 4.4-hectare site for loading and unloading.

In addition, Domodedovo is planning to develop a ‘first line’ cargo complex and a warehouse for perishable cargo.

Domodedovo currently operates all flights from its modern Terminal 1 building. Under the phased plans for growth, Terminal 1 will be enlarged and designated as the new Terminal 2, which will form part of the existing facility.

Domodedovo’s partner airlines serve 84 destinations exclusively from the airport. The trend that has been seen for international scheduled carriers to switch their operations from Sheremetyevo to Domodedovo (including Qatar Airways, British Airways, Vietnam airlines and JAL to name a few), has now eased enough to put Domodedovo on a more competitive footing with Sheremetyevo, whose Aeroflot-owned Terminal 3 is likely to pave the way for new trends in traffic flow. “The question is not who will be the bigger air hub – we have 240,000 hectares of land we can use, of which we own half. The big question is which traffic will depart and land from which airport. We have more scheduled traffic than Sheremetyevo, but they now have Aeroflot,” said Burkard. “I hope we will compete with Sheremetyevo in service quality.”