By Ralph Anker, Editor, anna.aero

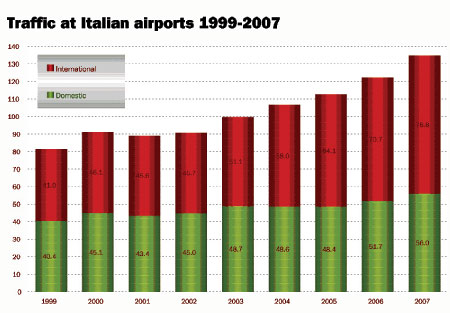

Despite the ongoing soap opera that may (or may not) soon determine the future of Alitalia, Italy’s airports reported impressive 10% growth in 2007. This is the fastest rate of growth since 2000, when traffic grew by 12%.

Source: Assaeroporti

Passenger numbers have grown by almost 50% at Italy’s airports since 2002. However, domestic traffic has grown by just 24% during this period, while international traffic, stimulated by the growing presence of low-cost carriers, has grown three times faster at 72%. In 2002, domestic passenger numbers at Italy’s airports were similar to the number of international passengers, but now there are 40% more international passengers.

Varying airport growth rates

Source: Assaeroporti

A look at individual airports in 2007 shows that Italy has 21 airports which handled over one million passengers and a further eight that handled between a quarter of a million and one million passengers. Rome Fiumicino with almost 33 million passengers and Milan Malpensa with almost 24 million passengers dominate the airport scene, with Milan’s downtown Linate airport in third with just under 10 million passengers.

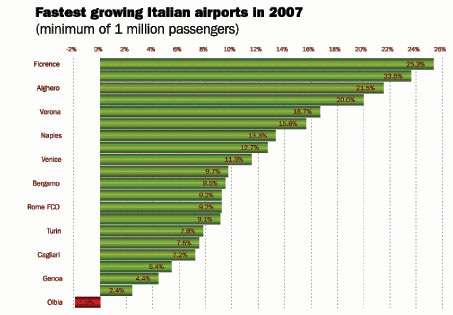

Venice (7.06 million), Catania (6.08 million), Naples (5.76 million), Milan Bergamo (5.74 million) and Rome Ciampino (5.35 million) are the next busiest airports. The last two have grown rapidly in recent years as bases for both Italian and foreign low-cost airlines. Nearly all of Italy’s 21 biggest airports reported growth in 2007, the exception being Olbia on the island of Sardinia where traffic declined 2% last year.

The fastest growing airports in 2007 were Florence, Pisa, Alghero and Bari which all reported traffic growth of over 20%. Both of Rome’s airports grew by 9%, though Ciampino’s growth was held back after local authorities decided to impose a movement limit at the airport, a decision that Ryanair claimed was politically motivated to reduce competition with Alitalia at Fiumicino. While Milan Malpensa and Bergamo grew by almost 10%, Milan Linate grew by just over 2%. Despite this, to the bewilderment of many, Linate managed to pick up an OAG Airport Marketing Award at last year’s Routes conference.

Alitalia – only one-sixth of international market

According to OAG data (for week commencing 18 February 2008) Alitalia is still the leading airline in the domestic market with around 34% of flights and seats. Potential suitor Air One has a 24% share of capacity, while Meridiana has an 11% share. Then come five LCCs led by Windjet with 7.5% of the market, Ryanair (3.9%), MyAir (3.3%), easyJet (2.5%) and Volareweb (2.1%).

On international routes Alitalia’s available seat capacity is rapidly being caught by Ryanair. While the flag-carrier currently has an 18% share of the market, Ryanair, which operates from over 20 airports in Italy and has bases in Milan (six aircraft), Pisa (three aircraft) and Rome (five aircraft), has over 15% and is gaining rapidly. Lufthansa (7.4%), easyJet (6.1%) and Air France (5.0%) are the only other carriers with at least a five percent share of the market. LCCs now have an estimated 38% of capacity on international scheduled routes in to and out of Italian airports.

Local LCCs following different business models

Italy has a range of home-grown LCCs. Volareweb, operating a fleet of A320s, was at one time Europe’s third largest LCC until it collapsed in November 2004. It was reborn in 2005 and has been a niche carrier at Milan Linate until this winter when it embarked on a major expansion programme from Milan Malpensa. MyAir which also started out operating only A320s is now ‘doing a JetBlue’ and combining A320 operations with smaller jet operations, in this case Bombardier CRJ900s. Windjet mixes charter flights with primarily scheduled domestic flights from Sicily (Catania and Palermo) to the mainland. Blu-Express, a subsidiary of charter airline Blue Panorama, operates mostly domestic services from Rome Fiumicino. All of these carriers have kept well away from attempting to enter the highly competitive UK or German markets, which consist mainly of in-bound leisure passengers, as these are dominated by LCCs based in those countries.