Istanbul Sabiha Gökçen’s passenger numbers grew by an impressive +74.2% in 2010, making it the fastest growing airport in the 10-25 million passengers category. Wizz Air launched services between Istanbul Sabiha Gökçen and Budapest in December.

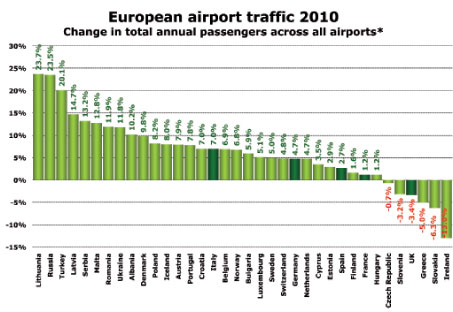

Based on anna.aero’s comprehensive database of traffic data and trends for over 300 European airports, it is estimated that passenger numbers handled at Europe’s airports in 2010 grew by around +4.2%. If we factor in the impact of the Icelandic ash cloud, which caused around a -20% decline in traffic for April, then the underlying growth for 2010 is probably between +6% and +6.5%. Analysis of data for 36 European countries shows that the performance of individual countries varied between Lithuania and Russia (growth of +24%) and Ireland (a decline of -13%). Thirty of the 36 countries analysed reported growth last year with three Western European countries (Greece, Ireland and the United Kingdom) joined by three Central European countries (Czech Republic, Slovakia and Slovenia) in reporting a fall in air passenger demand.

The figures for 2010 highlight the vibrancy of the Turkish air travel market. Ankara, for example, achieved growth of +27.5% and that trend looks set to continue in 2011. AnadoluJet launched services between Ankara and London Stansted in January.

The graph highlights the five biggest European country markets; the UK (214 million airport passengers), Spain (193 million), Germany (191 million), France (143 million) and Italy (140 million). Turkish airports passed the 100 million mark for the first time in 2010 and given their impressive growth in recent years it may be as soon as 2013 or 2014 that Turkey moves into fourth place in Europe.

Given the impact that a travel tax had on Irish air travel demand (along with one of the more serious economic collapses across Europe) it will be interesting to see what impact the new Austrian and German air travel taxes, introduced at the beginning of 2011, will have on air travel demand. In January, at least, passenger numbers at German airports were still +7.5% up on January 2010.

Source: ADP, ADV, Aena, ANA, Assaeroporti, Avinor, DAA, DHMI, Finavia, Swedavia, UK CAA and individual airports * In some cases data for only the largest airports in a country has been used. Some airports have only reported traffic data to November, in which case anna.aero has estimated the data for the whole year. For the Ukraine, data is based on January-September.

Using ACI EUROPE’s airport size classification we can see which airports reported the highest growth in 2010.

| > 25 million passengers

(Group 1) |

10-25 million passengers

(Group 2) |

5-10 million passengers

(Group 3) |

< 5 million passengers

(Group 4) |

| Istanbul IST (+7.7%) | Istanbul SAW (+74.2%) | Brussels CRL (+32.3%) | Kaunas (+77.3%) |

| Rome FCO (+7.4%) | Antalya (+18.7%) | Ankara (+27.5%) | Trapani (+57.5%) |

| Barcelona (+6.9%) | Copenhagen (+9.1%) | Moscow VKO (+22.4%) | Brindisi (+47.2%) |

| Munich (+6.2%) | Vienna (+8.7%) | Izmir (+20.7%) | Rimini (+45.1%) |

| Frankfurt (+4.1%) | Milan MXP (+8.0%) | Porto (+17.1%) | Diyarbakir (+32.5%) |

Istanbul’s airports do the double

Brussels Charleroi’s passenger numbers grew by +32.3% in 2010, making it the fastest growing airport in the 5-10 million passengers category. Jetairfly launched twice-weekly services from Brussels Charleroi to Toulon in October. The 133 passengers on the inaugural flight were welcomed by two rugby teams: the Charleroi Black Stars and RTC Toulon.

Istanbul’s two airports (Atatürk and Sabiha Gökçen) both managed to come top in their respective size categories, vividly demonstrating the vibrant growth in the Turkish air travel market. The winners in the other two size categories (Brussels Charleroi and Kaunas) both enjoyed impressive low-cost carrier (LCC) traffic growth in 2010. The LCC influence also helps explain the appearance of Barcelona, Porto and Trapani in these rankings. However, this winter Ryanair’s monthly year-on-year growth has fallen to well under +10%, as higher fuel costs, increased taxation (leading to higher fares) and seasonality of demand have combined to encourage the airline to grow winter capacity relatively modestly.

Other factors influencing growth at particular airports were Alitalia in Rome, the opening of the low-cost ‘Go’ pier at Copenhagen airport, Lufthansa Italia and easyJet growth at Milan Malpensa, and the relative strength of the German economy (and hence Lufthansa) at Frankfurt and Munich.

Istanbul Atatürk achieved growth of +7.7% in 2010 – the highest of ACI EUROPE’s Group 1 airports (airports with more than 25 million passengers per year).

The airports in each ACI EUROPE category that reported the biggest percentage fall in passenger numbers were London Gatwick (Group 1, -3.2%), Dublin (Group 2, -10.1%), Glasgow (Group 3, -9.3%) and Shannon (Group 4, -37.2%). The fact that all four of these airports are in either the UK or Ireland, where low-cost carriers have in the past been most influential in stimulating demand, is food for thought (as is the fact that both have suffered from increased taxation on air travel), though the fact that the two countries were also among the hardest hit by the global recession is obviously a significant factor as well.