Back in the day, running a hub airport meant doing everything you could to ensure the health of your home carrier. Gradually, it became about doing that, while attracting a broader mix of airlines and air services and of course passengers. It’s still about those things. But increasingly, CEOs have to worry about competition from other hubs too. Report by Elliot Bailey.

The nature of the competition between airports has been well-documented over the past 10 years in particular – nowadays it typically gets a mention in articles profiling Low Cost Carrier CEOs and how they enjoy being courted by airports big and small, from far and wide, each vying for a slice of LCC growth. This has been the case for a long time, but since Ryanair’s Damascene conversion 4 years ago when they decided to shift focus to primary airports, the competition has intensified between hubs and point-to-point airports, all eager to prove they’re the best place for Ryanair to grow.

But hub competition is another strand of this evolution in the business. Hub airports are also powerful platforms for airlines to develop their networks, and therefore attract significant attention. Many regions or countries would like to develop their own hubs, to tap into the benefits of the platform.

Consider the examples of Keflavik, Abu Dhabi, Doha and Dubai – these hubs are all based in countries with small populations, but they were built with the idea of attracting lots of transfer passengers. Up and coming hubs such as Brussels, Dublin, Vienna, Stockholm and Oslo are all gaining momentum too, as is the phenomenon of self-hubbing (eg. Dublin, Gatwick and Milan). And in the past 18 months, Ryanair and easyJet have both signed cooperations with long haul airlines to act as feeders for their services. So, different types of hubbing are bubbling away under the surface of what can sometimes look like a very point-to-point market.

With several major airline groups now operating multi-hub strategies, they are able to play hub options against each other in negotiations as well. Long-term competition amongst hubs can be seen through many developments in Europe, described below.

Transfer Passenger Experience

Beyond the B2B aspect, another angle of hub competition is linked to hub airports’ own reputation and brand among travellers. In today’s multi-channel communications world, with big brands, passenger experience campaigns, pop-up stores, travel bloggers and influencers, anyone travelling to another continent can typically do it through all manner of hub transfer options. The internet is awash with listicles and travel inspiration, sagely advising those with wanderlust where the best airport experiences are and the different things on offer at a vast array of hub airports.

Now consider for a moment how you could travel from Lyon in France to a secondary airport in China. There is no direct service and the options at your disposal include transfer through Paris CDG, Amsterdam-Schiphol, Zurich, Helsinki, Istanbul or Dubai, Abu Dhabi or Doha, or Hong Kong, Beijing or Quindao or Xi’an. Independent research indicates that price is not the only determinant here and typically an air traveller will consider the nexus of price, duration of flights, airline service and airport experience.

Staying on the example of China – it will be the world’s fastest growing aviation market between now and 2040. The EU-China market will naturally grow as passengers from more European and Chinese regions transfer through hubs to reach the other region.

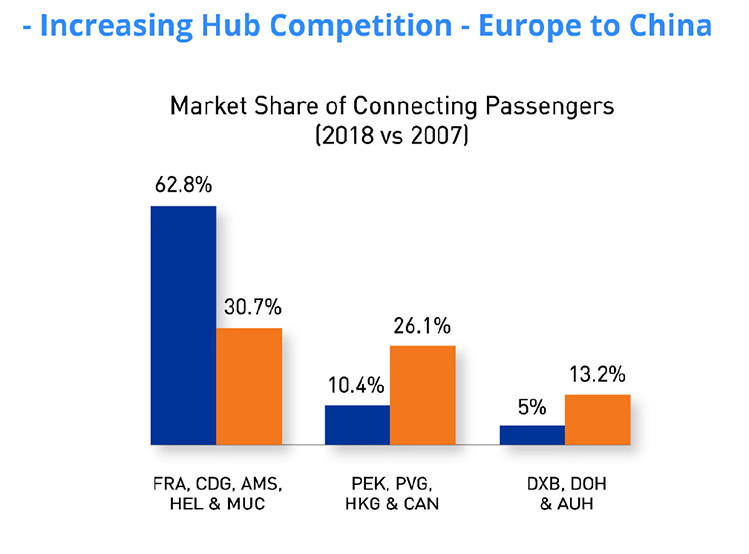

The top European hubs for air traffic between Europe and China (Frankfurt, Paris-CDG, Amsterdam-Schiphol, Helsinki and Munich) have seen their market share of connecting passengers fall significantly over the past 10 years to the benefit primarily of Chinese hubs (Beijing, Shanghai, Hong Kong and Guangzhou) and also Gulf hubs (Dubai, Doha and Abu Dhabi). To a certain extent this is expected, as Chinese airports and their airline partners develop, but the question is what size will the eventual market be and which airports will be able to have the largest share?

This is also one of the reasons why Europe’s hub airports are increasingly developing specific strategies to attract Chinese transfer passengers, eg. Groupe ADP’s campaign on Chinese social network WeChat, Finavia’s brilliant ‘MatchMadeinHEL’ campaign to name but two.

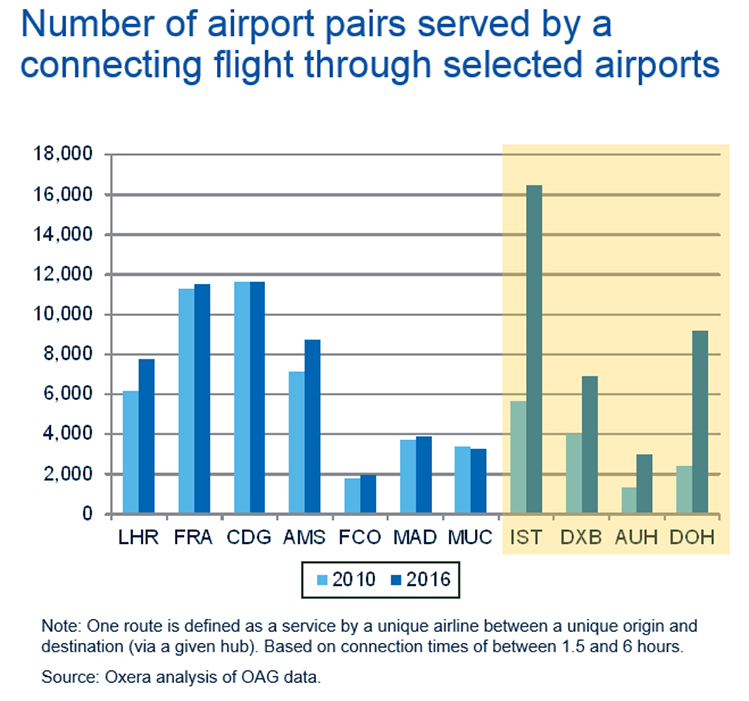

More broadly in EU-Asia connectivity, hubs in the Persian Gulf and in Turkey are using their geographical comparative advantage and alliances with airlines to develop and capture market share on the EU to Africa and Asian markets. This has seen a large increase in the share of routes from Europe’s 5 largest hubs that are now competed by the Persian Gulf and Istanbul hub airports.

Meanwhile, back in Europe, key airline groups have been making headlines for their strategic priorities.

That One Big Customer Effect

Another recent example of more local hub competition is Lufthansa’s strategy for the deployment of some of its flagship aircraft. Frankfurt Airport and Munich Airport both have the same hub customer accounting for more than 2/3 of their traffic. At Frankfurt, the Lufthansa Group has 65.5% of all traffic, and at Munich the Lufthansa Group has 68.3% of all traffic (May 2018-April 2019 season, OAG).

In June 2017, Lufthansa announced that it would move 5 of its A380s, from Frankfurt to Munich. The AFP quoted a Lufthansa spokesperson saying, “growth will happen where the best conditions are, and costs are of course a factor.”

This came in the wake Lufthansa’s previous decision to base its A350 aircraft, the newest Airbus long-haul aircraft, at Munich Airport, rather than Frankfurt.

A press release from the Lufthansa Group in September 2018 spells out the pressure, directly stating, “Our multi-hub system […] makes it possible for us to react to changing conditions with extreme speed and flexibility. Our key factors are quality, efficiency and cost effectiveness.”

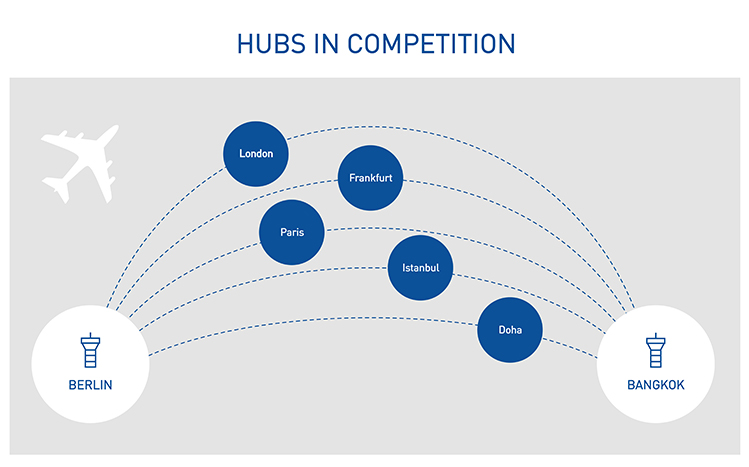

And even more interestingly, in their recent own Policy Brief newsletter, Lufthansa also explained the hub competition phenomenon by spelling out the hub airports competing with each other on a routing between Berlin and Bangkok.

Adapted from Lufthansa Policy Brief 5: https://politikbrief.lufthansagroup.com/en/policybrief-5-2018/#c6033

The ‘one big customer effect’ is pervasive. At Europe’s hubs and large airports, the dominant airline group controls on average 54.2% of all departing flights. When a business is so reliant on one customer, its development, quality and prices all become heavily influenced by that customer.

Recent market research revealed that last year, the Top 5 biggest airlines in Europe crossed the threshold of holding 50% of the market – another indication of which part of the air transport sector really holds the cards.