A discussion with DHMI General Manager and Chair, Funda Ocak. Interview by Paul Hogan

Funda Ocak was appointed the DHMI Director General in October 2016, the very first woman to hold the post (although it was noticeable that Ocak did not once refer to gender as an issue during our entire interview). Ocak’s promotion to the top job of the 55-strong state airports group (and controller of 1 million square kilometres of airspace) crowns a 35-year career with DHMI, including service as Deputy DG and a member of the board since 2007. Her complete familiarity with Turkey’s airports industry, and a long career marked by “many different periods and many changes” gave a significant advantage in preparing Ocak for taking command at the time of the greatest uncertainty since Turkey became a major global aviation player.

“Focusing our dreams on a global future”

However, after the multiple shocks of 2016 (commonly referred to as the ‘missing year’), 2017 saw a solid return to stability, the return of tourists, and the return of transfer passengers over Istanbul Atatürk.

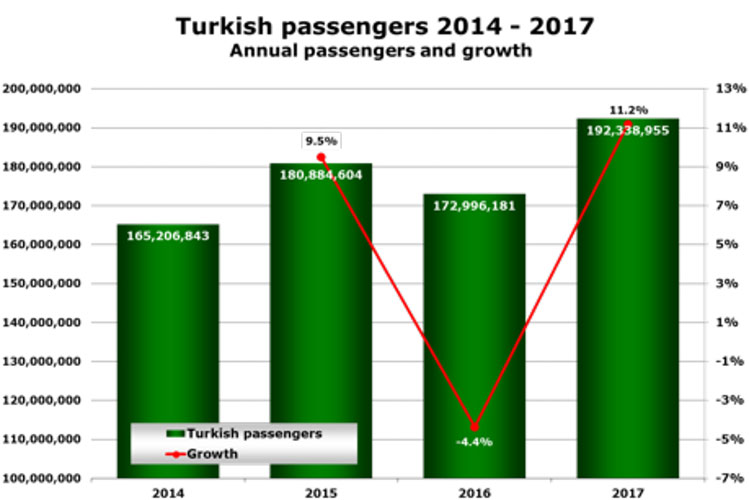

The resulting 11% growth in Turkey last year produced 193 million passengers at DHMI airports – a new best-ever year for Turkey (and making it Europe’s 5th biggest air transport country, just behind France). “The new growth is very joyful for us,” says Ocak. “2017 was the year of rehabilitation – the changes of the last two years have been very rapid, but equally DHMI has proved that we are very fast at adjusting and taking action. Now, in 2018, we are predicting that we will maintain these improvements, and traffic will exceed 210 million passengers.”

Ocak, believes the growth trend in aviation is linked to Turkey being a global aviation connecting centre and a transit hub, also the growth in economics is linked with the aviation sector and is acting as the main dynamo, and DHMI is at the core of this sector.

After her appointment to duty, Ocak stated that DHMI management has undergone reconstruction. One of her main objectives is to update the current structure and to adapt to the needs of the day. “We have taken important steps in marketing our experience on the international market, customer service, press relations are re-audited, DHMI has a great PPP experience, we have gathered the disorganised structure within this institution.”

Turkey’s airports have certainly bounced back, with traffic up 11% in 2017, the “missing year” of 2016 produced overall declines of 4.4%, although that was felt far more at some airports than others – Antalya, once Turkey’s second-biggest airport, was heavily exposed to a Russian boycott, with the result that traffic was halved.

The top Turkish airports in 2017

Istanbul Atatürk up 6% to 63.73m

Istanbul Sabiha Gökçen up 6.1% to 31.39m

Antalya up 38% to 25.93m

Ankara up 22% to 15.85m

Izmir up 7.3% to 12.82m

In office, Ocak has already overhauled many aspects of DHMI’s large administration: “One of my first main aims was to update the department structures and their day-to-day responsibilities – especially outward-looking departments such as customer services and press relations. DHMI also has a huge experience of PPP, so we have taken steps to cluster these skills in a new department specialising in privatisation as our PPP path to airport development is likely to be driven further as DHMI airports continue to grow.”

During the most difficult times of 2016 Ocak maintains that, besides taking measures to preserve the stability of its own operations: “As DHMI, we have implemented significant incentives through tariffs to help private partners in the aviation sector. For our future, we focused on our dreams.”

Part of this future is what Ocak describes as “our dreams for globalising – we have previously discussed exporting our talents as a global airports leader, we have a vast capability and know-how, and we have many areas where we want to work in the international theatre.” While Ocak agrees DHMI would need to achieve a change in its statutes to perform international business outside of Turkey she says: “We have made all the changes necessary for the conditions for this to happen.”

Ocak thinks one of the key areas ripe for export is the potential to act as a PPP adviser. “We have all the abilities and considerable commercial expertise in developing 18 Turkish airports under the PPP model which we would be able offer in an advisory role to overseas airports and privatising governments.”

Istanbul New Airport – a Guinness World Record?

However, this year, DHMI’s attention remains much closer to home, focused on the opening of Istanbul New Airport on 29 October. “Progress of construction is very pleasing, there have been no interruptions to the day and night building of this 90 million passenger facility, and achieving this in just 42 months is something which will put us in the book of Guinness World Records.”

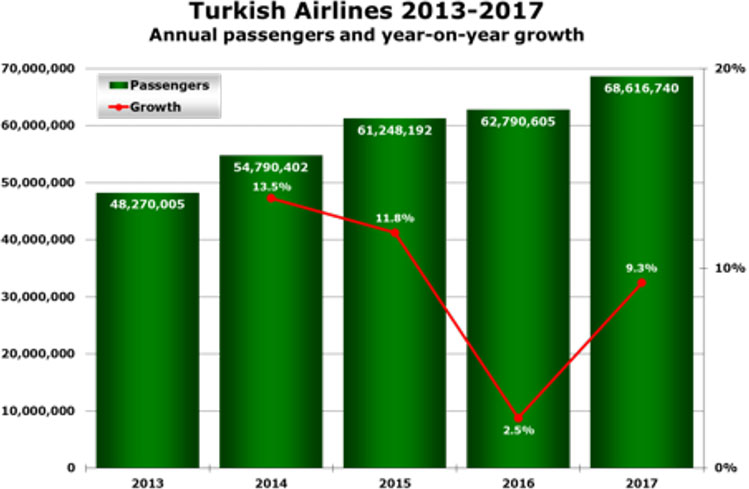

Turkish Airlines traffic growth stuttered in 2016, but rebounded with 9.3% in 2017, much nearer to the double-digits+ that it has historically enjoyed for most of the century with 9.3% in 2017. 2018 already looks better still. In January carryings were up 36% more than the same month of 2017. Not only that, but international-to-international connecting traffic in January was up 25%, a lot higher than the 3.5% growth rate seen in all of 2017 for this sector.

As the plans continue to emerge as to how the move to the new hub will be achieved in October, Ocak asserts that DHMI is ultimately in charge of the transfer process and holds chairmanship of the 12 sub committees, including the involvement of 100 stakeholders, that have been formed to organise the switch-over.

“Once Istanbul New Airport starts its services it will become the intercontinental hub between North and South from the Far East to Europe. With this mega project, Turkey takes a giant step forward towards its goal to become a global brand.”

Meanwhile, besides the new global mega-hub, Ocak continues to lead DHMI with 55 active airports in a widespread airport network system. Istanbul Sabiha Gökçen International Airport, which contrasts with Atatürk through its dominance by low cost carriers and its Anatolian (Asian) catchment area (and has also seen a big resurgence in its appeal to long haul carriers) rocketed forward by 6% in 2017 to reach a total of 31.4 million. A new second runway will open at ‘Sabiha’ in 2019, although renovation of the existing runway means that it will not fully become a two-parallel runway system until 2021. After the second runway is completed, Ocak says “a second terminal at Sabiha Gökçen will be considered.”

Since the Malaysian Airport operator, the main partner of the company operating the Sabiha Gökçen Airport Terminal, has claimed that some of its own franchise rights will soon be sold to the main partner of the company, Ocak agrees that this is very likely to be of interest to TAV Airports after Istanbul Atatürk closes to commercial traffic (TAV originally offered to buy a stake in the airport in 2014). (Meanwhile, TAV is buying the IC İçtaş 49% stake in ICF Antalya, the joint-venture that manages Antalya Airport, now the third largest in Turkey with just under 26 million passengers last year).

(Source: Turkish Airlines)

Elsewhere across Turkey DHMI directly operates 49 out of the 55 airports under its ownership. Most of these are vital regional airports serving “all Turkey” – both resorts and regional business centres. Under Ocak DHMI will continue to develop airports across Turkey, including this year’s opening of Çukurova Regional Airport near Adana which Ocak describes as “the other important new Turkish airport”. Ocak goes as far as to call Çukurova “a promising candidate to become the greatest dynamo after the highly developing Istanbul/Izmit Kocaeli region. Indeed, all DHMI airports – whether global or hub, or regional – all combine to serve our global ambitions for the Turkish brand.”

DHMI General Manager and Chair, Funda Ocak, interviewed by Paul Hogan at DHMI HQ, Ankara.