The last week of September saw two parallel events that highlighted just how strongly airports are now competing with each other. The first was World Routes in Barcelona, where the route development teams of 750 airports big & small rolled out their pitches to airlines. The second was a gathering in Brussels, at which Oxera and ACI EUROPE released a new study on airport competition in Europe. Report by Elliot Bailey and Agata Lyznik.

The last week of September saw two parallel events that highlighted just how strongly airports are now competing with each other. The first was World Routes in Barcelona, where the route development teams of 750 airports big & small rolled out their pitches to airlines. The second was a gathering in Brussels, at which Oxera and ACI EUROPE released a new study on airport competition in Europe. Report by Elliot Bailey and Agata Lyznik.

Airlines and airports generally work very well together on many aspects of the air transport ecosystem – it is an undeniably symbiotic relationship. One cannot thrive without the other, whichever way you look at it. However, the issue of airport charges can still often be the source of a thorny disagreement. This is partly due to airlines yearning for more nostalgic times when airports were often under the instruction of their national governments and told to do whatever was needed to keep the home carrier afloat. But as the European Single Aviation Market celebrates 25 years this year and over 40% of Europe’s airports now have private shareholders, it’s fair to say that over that period, times have most definitely changed. Indeed, while they often talk about the evolution of their industry over the past two decades, it is curious how airlines rarely acknowledge a similar evolution in the airport industry.

“Of airlines & airport charges”

In the context of the EU Aviation Strategy launched in December 2015, one of the airline associations’ big ideas was revisiting airport charges regulation – something that seems somewhat out of sync with pillars of the actual strategy: more Open Skies with third countries and a more consumer-centric focus, with implications on capacity and quality. But armed with the extraordinary media megaphone of some of Europe’s biggest (most dominant and most profitable) airlines, the airlines’ campaign on airport charges has done the rounds over the past 18 months.

That the European Commission is currently evaluating the EU Directive on airport charges, is no coincidence, but for now, it is only an evaluation – not necessarily leading to a revision. The jury is still out on the possibility of that and the result may be revealed before the end of the year, but in the meantime, airports are not taking any of the accusations lying down.

Accusations by Airlines 4 Europe (A4E) last year about the Top 21 airports in Europe were addressed and rebutted comprehensively in an ACI EUROPE Analysis Paper published some months later. When the European Commission arranged a special Symposium in Florence dedicated entirely to airport charges on 17 June of this year, the eventual participation revealed a curious shyness on the part of the airlines: 11 airport operators attended, ready to discuss the issue, while only 4 airlines managed to make it along, with many more being unavailable.

Then on 27 September, the day after the release of Oxera’s study The Continuing Development of Airport Competition, IATA released an Economics Report of a mere 2 pages, making simplistic and extremely selective claims about airport passenger charges. (The common denominator between A4E and IATA is of course that the current IATA CEO and DG is Alexandre de Juniac, who was one of the founders of A4E, during his previous role as the CEO of Air France-KLM). Plus ça change… Nevertheless, ACI EUROPE issued a rebuttal the very next day. But the temperature hasn’t just been rising in associations’ exchanges about airport charges. It might be hot in the aeropolitical kitchen, but it’s even hotter out there in the market.

The Oxera Study

The key findings of the Oxera Study were presented at a gathering at the European Aviation Club in Brussels by Olivier Jankovec, Director General of ACI EUROPE as part of his State of the Airport Industry address. Over 90 air transport stakeholders from airports, airlines, the European Commission (DG MOVE), the European Parliament and national delegations were in attendance.

In researching and analysing airport competition, Oxera worked with the direction of Dr. Harry Bush, former Group Director of Economic Regulation at the UK Civil Aviation Authority. They found compelling evidence of growing competition between Europe’s airports – in part due to structural shifts in the airline business, in part due to other factors.

The key findings of this study were presented at a gathering at the European Aviation Club in Brussels by Olivier Jankovec, Director General of ACI EUROPE as part of his State of the Airport Industry address. Over 90 air transport stakeholders from airports, airlines, the European Commission (DG MOVE), the European Parliament and national delegations were in attendance.

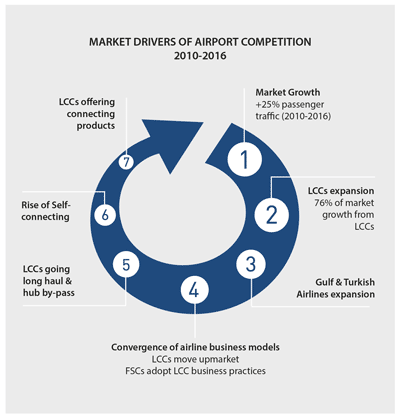

As already established by previous studies, competition between airports for airlines and passengers is an indisputable part of the European air transport system. Ryanair’s CEO, Michael O’Leary has even acknowledged it. However, the latest research by Oxera reveals that both the nature and intensity of that competition have significantly changed since 2010, fuelled by the cumulative impact of disruptive market developments – including the relentless expansion of both Low Cost Carriers (LCCs) and Gulf airlines and the convergence of airlines’ business models.

Jankovec commented “The Oxera study confirms the cut and thrust of what running an airport in Europe means today – irrespective of size and location. With traffic growth almost exclusively generated by highly mobile and mostly route-agnostic airlines, airports no longer just compete on a local basis with other airports serving the same catchment area. Airports now compete on a Pan-European basis to attract new air services and retain the ones they have. This involves many airlines now routinely running ‘beauty contests’ amongst airports to get the best deals – with airports systematically offering financial incentives and other forms of support.”

In its new study, Oxera also points to the development of much increased competitive pressures at medium-sized and larger airports – including hubs. Indeed, route churn rates – which indicate the extent of route switching – have gone up primarily at these airports and are actually converging with those of smaller airports. The main factors at play here are the move of LCCs into primary airports, the development of powerful competing hubs in the Middle East, the beginnings of new hubbing capabilities at other airports with passenger self-connections and LCCs and airports offering new connecting products, as well as the availability of more direct air services that allow passengers to by-pass hubs entirely.

Andrew Meaney, Partner & Head of Transport at Oxera said “What our study confirms is that the competitive landscape of the European aviation market is evolving rapidly and competition between airports is both widespread and increasing. Many of the market trends driving this are well-established and likely to continue – further raising the pressure on airports of all sizes across Europe. In an industry with largely fixed costs and long design periods, this means that airports, their customers, regulators and governments will all need to come to terms with this reality.”

Meanwhile at ROUTES in Barcelona…

In an effort to go beyond the aeropolitical scene in Brussels, we travelled to Barcelona for the latest ROUTES route development conference and sought out various airport and airline representatives to get their take on the live dynamics between airports and airlines. For those readers unfamiliar with ROUTES, it is a series of conferences & exhibitions at which airports pay significant sums to attend and exhibit, to meet airlines (who attend for free). Over the course of 2 days interviewing people – incidentally, this was prior to the announcement of the release of Oxera’s new study – we found plenty of evidence of intensified competition between the airports present. Interestingly, none of the airline representatives we met there would agree to be interviewed…

Amid the speed-dating sessions between airports and airlines and the hundreds of meetings taking place over the duration of the conference, we spoke with airports of different sizes, asking them about their reasons for attending and their take on the current market dynamics.

Kam Jandu, Chief Commercial Officer at Budapest Airport (11.4 million passengers in 2016): “There are two aspects to attending events like this. The first is to make sure that you’re maintaining the airline relationships you already have – because there is no room for complacency in our industry. You want to make sure that the airlines already operating at your airport continue to do so or increase the operations they already have in place. The second is to meet new airlines and make new contacts.”

Kam Jandu, Chief Commercial Officer at Budapest Airport (11.4 million passengers in 2016) outlined the reasons why his airport always attends “There are two aspects to attending events like this. The first is to make sure that you’re maintaining the airline relationships you already have – because there is no room for complacency in our industry. You want to make sure that the airlines already operating at your airport continue to do so or increase the operations they already have in place. The second is to meet new airlines and make new contacts because it is always a much more difficult proposition to try to get more airlines to come to your destination – because they have plenty of options and plenty of choice.”

Following on from their success in getting a long haul route going with Norwegian, Niall MacCarthy, Managing Director of Cork Airport (2.2 million passengers in 2016) was back again at the event. “We come here to meet prospective airlines and current airlines and we’re pitching new routes into Cork. Saying that though, it’s all about relationships – route development isn’t about quick sales, “it’s got more aggressive. Outbound competition has become very dog-eat-dog with overlapping catchment areas between airports and more choice for passengers. You have to offer a good product. Passengers want good service quality, but at the same time, there’s pressure from the airlines to reduce costs.”

Léon Verhallen, Head of Aviation Development from Brussels Airport (22 million passengers in 2016) and a stalwart of these events for 20 years now is equally effusive: “As an airport you have to be here – it is the opportunity to profile your airport to the airline community. It’s a significant investment each year, but we have to do it.” On the matter of competition, Léon commented “Every year it’s getting more competitive. At this event, there are 750 airports (from all over the world). You see more and more airports of all sizes opening new short haul and new long haul routes – so even more competing with each other. Airline marketing is not only Brussels Airport versus Copenhagen or Vienna. It’s also Brussels Airport competing with Dallas or Los Angeles because an airline can only operate an A350 once (a day) not twice.”

Léon Verhallen, Head of Aviation Development from Brussels Airport (22 million passengers in 2016): “Every year it’s getting more competitive. At this event, there are 750 airports (from all over the world). You see more and more airports of all sizes opening new short haul and new long haul routes – so even more competing with each other.”

Perhaps it’s best to give the final word to Dr. Harry Bush, the man credited as the Godfather of airport competition in the UK, who at the release of the Oxera Study, commented “The extent to which competitive pressures have been converging across the European airport industry over the past 7 years is a significant development. This has given airlines greater negotiating leverage – leading airports of all sizes to compete not just on price, but also on capacity and quality. This ‘new normal’ in the airport-airline relationship is still too often overlooked or even dismissed. This is why the Oxera study is important – especially now with the Commission evaluating the EU Directive on airport charges. Oxera’s findings suggest that this is no need for more regulation of airports. On the contrary, they argue for less and more proportionate interference with the market.”

The Oxera Study “The Continuing Development of Airport Competition in Europe” and a dedicated ACI EUROPE Synopsis entitled “The Competitive Edge: Airports in Europe” are both available for download from the Policy Library on the ACI EUROPE website: www.aci-europe.org