The latest ACI EUROPE Airport Industry Connectivity Report was released at the 26th ACI EUROPE Annual General Assembly, Congress & Exhibition in Athens in June. Now in its third year, this unique ACI EUROPE Report looks at developments in air connectivity at an airport, national & European level, over the previous year. Inês Rebelo reports.

The Report focuses on hub connectivity this year, and examines in detail how a range of European hubs compare with each other and with their peers across the globe.

Connectivity has gone from being a technical word exclusively associated to telecoms and IT, to one with a far richer meaning in the globalised world of today. Given the extraordinary facility that air transport offers by linking cities, regions and countries – the word ‘connectivity’ is a fitting description of the value it generates, one that ACI EUROPE felt that demanded more analysis.

In this third edition of the Connectivity report – conducted in partnership with SEO Aviation Economics – we see that the evolving dynamics and structure of the aviation market are leading to changing air connectivity patterns for Europe. The Report reveals that while 2016 was a good year for direct connectivity growth, indirect connectivity (which looks at flights via a transfer airport) did not increase accordingly. This development reflects shifts in the airline market, and given the importance of air connectivity for wider economic activity, is a trend that will need to be monitored closely.

The Report also reveals that the continued rise of Low Cost Carriers & point-to-point services and the relative retrenchment of legacy carriers & hub and spoke services has led to an unusually strong growth in direct connectivity (+4.5%) this year. More airlines are starting new services made possible by aircraft like the Boeing 787 Dreamliner and Airbus A350 – this is one of the factors at play in the increase in point-to-point services.

Conversely, indirect connectivity and hub connectivity have barely increased (+0.4% and +1%). This disconnect is quite unprecedented as direct connectivity growth usually yields even larger indirect and hub connectivity gains.

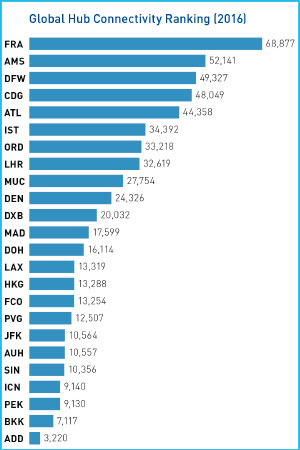

The Report also focuses on hub connectivity this year, and examines in detail how a range of European hubs compare with each other and with their peers across the globe. Led by Frankfurt, Amsterdam-Schiphol and Paris-Charles de Gaulle, the major European hub airports, which include Frankfurt, Amsterdam-Schiphol, Paris-Charles de Gaulle, Istanbul-Atatürk, London-Heathrow and Munich, remain prominent in the Global ranking – offering the best and most diversified hub connectivity of the worlds’ hub airports. And these findings naturally underline their role as vital providers of global air connectivity for Europe.

The latest ACI EUROPE Airport Industry Connectivity Report was released at the 26th ACI EUROPE Annual General Assembly, Congress & Exhibition in Athens in June.

However, the Report also finds that most of the growth in air connectivity in 2016 is happening at smaller hubs and other mid-sized airports. Meanwhile, many very large airports – and especially the major hubs – are experiencing a decrease in both their total air connectivity levels (direct & indirect connectivity) and hub connectivity levels.

With the EU Aviation Strategy putting a clear emphasis on connectivity (and consumers) and various new aviation agreements with Ukraine, Qatar and the ASEAN countries currently in the early stages of development, documenting the trends in airport connectivity is more important than ever.