An interview with Dr Sani Şener, CEO and founder of TAV Airports Holding. By Paul Hogan

“Definitely! If Sabiha Gökçen comes to market we would like to buy it. TAV Airports want its foothold in Istanbul.” Dr Sani Şener, CEO and founder of TAV Airports Holding and TAV Construction, is talking to Airport Business in his office in TAV’s headquarters at Istanbul Atatürk Airport. He is explaining his group’s determination to maintain its position as the operator of one of Istanbul’s major airports after it withdrew from the bidding process for Istanbul New Airport in 2013.

July 2015: TAV Construction lays the foundations of the new at Paris Charles de Gaulle Airport. TAV Construction is 49% held by ADPM – the international management arm of Aéroports de Paris – while the ADP holding in TAV Airports is 38%. “We do things separately, but we also do things together – right now we are bidding with ADP for a PPP for the development and operation of five airports in the Philippines.”

TAV had not waited long after this event to show its future aspirations. In the autumn of 2014 TAV moved to acquire a 40% holding in Sabiha Gökçen International Airport when this was relinquished by Limak (itself a major shareholder in the new airport currently under construction). At that time ‘Sabiha’s’ other main shareholder, Malaysia Airports Holdings, decided to activate its ‘first right of refusal’ to buy the Limak shares and it now wholly-owns Sabiha.

But this hasn’t changed Şener’s mind: “If I were them I would sell, it’s tough for the Malaysians not having a Turkish partner – I know this as we operate in many countries and I think it’s absolutely fundamental to have a local stakeholder. But we’re in contact with the Malaysians, and I am sure that they will eventually sell.”

In reality such a move for Şener’s TAV would be much more than just a “foothold” – Istanbul’s second airport is thundering along with sustained 20% growth; it will easily sail past the 30 million passenger threshold next year and is charging towards 50 million by around 2020. Şener agrees that, like other major cities – and at 14 million Istanbul is by far Europe’s largest – Istanbul needs more than one airport to serve its geographical sprawl as well as its O&D and transit traffic – both of which continue to average double-digit growth.

Serving the St Tropez of Turkey: In October TAV won the tender to take over the international terminal of Milas-Bodrum Airport. Şener has high hopes for creating a transformation on the scale of Antalya: “We expect traffic to grow to 10 million in 10 years, we are planning to make Bodrum popular for all 12 months of the year.”

TAV buys into “St Tropez of Turkey”

Meanwhile, outside of Istanbul, TAV continues to grow its portfolio both within Turkey and internationally. In October it won the tender to take over the international terminal of Milas-Bodrum Airport where it has also managed the domestic terminal since last year. The bid price of €717 million is for a 20-year lease but, while the international terminal has a modest current 1.4 million throughput, Şener has high hopes for creating a transformation on the scale of Antalya: “Bodrum is the St Tropez of Turkey, it is wealthy, it is growing fast and it will be the fourth-largest city in Turkey by 2025.”

Just like Antalya before it, Şener believes airport growth at Bodrum will be fed by resort growth with considerable incentives given to developers to build new hotels – possibly 50-year ‘rent holidays’ on development land – particularly on the coastline stretching north of Bodrum towards Didim. Consequently, Şener sees Bodrum as a considerable hope: “We expect the passenger traffic to grow to 10 million in 10 years – 3 times the size it is now. We are going to do a lot to develop routes and direct flights in association with the local tourist authorities, hotels and resorts, we are planning to make Bodrum a centre of attraction which will be popular for all 12 months of the year.”

Is TAV joining the Turkish push into Africa?

Outside of Turkey many Turkish enterprises have joined their government-sponsored push to invest in Africa, led by the high-profile charge of Turkish Airlines, which will end this year with 48 destinations across the continent. DHMI, the Turkish state airports organisation (and ultimate airport landlord of all 55 Turkish airports) has also announced aspirations to partner with Turkey’s airport operators and construction companies, typified by TAV, to export Turkey’s successful public-private-partnership (PPP) airport model to Africa.

Şener is both cautious about the scale of opportunity in Africa but, at the same time, explains that TAV is pursuing a real presence. “We have been deeply involved in North Africa with our concessions in Tunisia. Elsewhere TAV has entered into new ventures though our service companies – most notably we are operating an airport lounge at Nairobi. These market-entry devices are critical to finding our way and learning about how to work in new countries and with specific new partners, especially in Africa, where you need a great deal of experience – as well as expertise.”

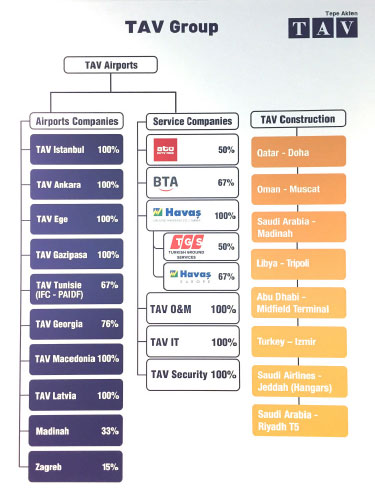

The expansion of TAV’s service companies – everything from the lounges, through to ground handling, duty free, F&B, and loyalty programmes – means that TAV now operates in some form or other on 70 airports worldwide. “We are a global company, and we are going to continue to pursue growth opportunities across the world which enhance the value of both TAV’s airport operations and service companies.”

For further example of this “everywhere” Şener gives the recent successes of its duty free retail subsidiary, ATU, which has just made an important entry into the US market by the winning the duty free tender at Houston George Bush Airport. Şener reports that ATU is already doing well in Houston “and there is huge room for growth – the Americans are good at science, research and product development, but we have excellent airport service solutions, and we are clearly very interested in being a duty free partner at other US airports. ATU has Heinemann as a shareholder – one of the best duty free shop operators in the world – it’s a big advantage!”

While airport services will continue to play a range of roles in TAV, contributing to the airports directly run by TAV, and opening the doors for new international markets such as Africa and the US, Şener also maintains these activities are of crucial shareholder value and make a significant contribution to TAV’s earnings – he estimates that F&B generates $200 million to TAV Airports turnover, while $400 million comes from duty free activities, and a further $200 million from ground handling.

TAV’s high profile entry into the US market was marked by the winning of the duty free tender by its ATU joint venture at Houston George Bush Airport over the summer. TAV’s service companies now operate on 70 airports worldwide. Şener: “We are a global company, we are going to continue to pursue growth opportunities across the world.”

Relations with ADP

TAV Construction is 49% held by ADPM – the international management arm of Aéroports de Paris – while the holding in TAV Airports is 38%. “We work very well together – they structured their company to a culture of international growth over 40 years ago when they first became involved in airport design all over the world, whereas our core contribution is our construction heritage. We are both top-four European airport operators and together we have 250 million passengers, which easily makes us the largest airport operational partners in the world with unrivalled knowledge and experience. We do things separately, but we also do things together – we each have a stake in the joint venture operating Zagreb Airport, we bid together for the operating rights of the central terminal building of New York’s LaGuardia Airport, and right now we are bidding with ADP again for a PPP for the development and operation of five airports in the Philippines.”

23 important partnerships

In addition to ADP the web of partnerships becomes complex at times: “In all we have 23 important partnerships in all our businesses” – besides ADP and Heinemann, significant relationships include those with Turkish Airlines in Turkish Ground Services, Saudi Öger and Al Rajhi groups in Saudi Arabia, TAV is also involved with Bouygues in Zagreb, while the Pan African Infrastructure Development Fund and World Bank’s International Finance Corporation has an important strategic shareholding in TAV Tunisia (which it defines as central to IFC’s published objectives of “fostering sustainable economic growth in developing countries by supporting private sector development.”) All of these linkages stand in addition to core concession partners covering 14 different airports.

Şener explains the pursuit of TAV’s desire to buy into Malaysia Airports Holdings Istanbul Sabiha Gökçen to Airport Business’ Paul Hogan: “If I were them I would sell, it’s tough for the Malaysians not having a Turkish partner.”

“When you have businesses like these you have to grow them. What we are doing is simple – there is diversity but there is also integration – all TAV Airport businesses are linked to each other for a competitive advantage – and there is lots of competition after all.”

Indeed the competiveness and capability of the TAV portfolio of eight diversified service companies was recently boosted when the TAV Academy was awarded ICAO-certification. “We have always trained people in-house, but long ago we saw a gap in the market – a chance for a training institute – and now it has ICAO recognition along with only 16 other private sector companies in the world authorised to provide certified civil aviation training; it is also one of just 15 ACI-recognised global training centres.” Besides its ability to provide training on certified roles “we have a total capacity to train anyone from our very large intellectual platform,” says Şener, who relates that it has most recently coached Chinese airport executives in the field of route development.

As a result of his “across the world” view, Şener agrees that TAV’s markets, and what it does in those theatres, is increasingly diversified: “But we always remain centred and connected with the airport business we know well. And our spread does not mean that we are not realistic and cautious: Africa, Asia and Asia Pacific will all continue with double-digit growth in the coming years, whereas Europe and America are saturated and probably manage mainly 4% – but there is scope for TAV’s enterprise everywhere.”

Şener’s selection: Most-desired routes at TAV’s airports

Ankara Esenboğa Airport: “The Turkish capital gets all the government traffic but there is considerable scope for more links to the main European cities – London, Amsterdam, Berlin and Vienna.”

Skopje Alexander The Great Airport, Macedonia: “Skopje is already a successful Wizz Air base, but we think there is considerable opportunity for more low cost operators.”

Madinah, Saudi Arabia: “More Asian routes – it has plenty of charters, but we would like some scheduled services.”

Zagreb, Croatia: “New York!”