Source: OAG Max Online for w/c 6 August 2012 and w/c 1 August 2011

Despite the economic difficulties being experienced across much of Europe this Summer, the region’s airports and airlines have remained reasonably resilient according to anna.aero’s analysis of OAG schedule data for August. This shows that across 644 European airports scheduled seat capacity is up 1.2%, while aircraft movements are down 1.5%. Considering that since last summer two major airlines have closed down (Malév and Spanair) and a number of smaller regional carriers have also ceased operating (Air Finland, Cimber Sterling, Czech Connect Airlines, Skyways) a small increase in total seat capacity can be viewed as impressive.

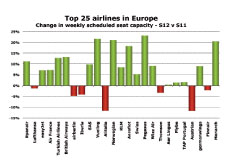

Analysis of the top 25 airlines operating at European airports reveals that 18 of them, including five of the top six, increased weekly seat capacity on a year-on-year basis. The seven top 25 carriers that have reduced capacity are Lufthansa, airberlin, Iberia, Alitalia, Thomson Airlines, Austrian and Finnair. Ryanair, Europe’s biggest carrier in terms of weekly seat capacity from European airports, increased seat capacity in August by over 10% according to OAG data, thus further increasing its lead over Lufthansa, which could soon be overtaken for second place by easyJet.

Air France’s growth is primarily down to its regional airport expansion in France, while British Airways has already absorbed bmi British Midlands’ European network at London Heathrow. Four of the top 25 airlines have reported impressive growth of over 20% in capacity during the last year. All four are LCCs with Vueling expanding considerably in Barcelona, Norwegian across many of its Nordic bases, Pegasus in Turkey and Monarch at various UK airports.

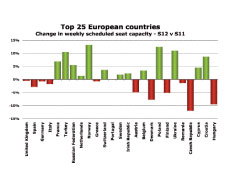

Top four country markets shrinking, Norway and Turkey still growing

Analysis of seat capacity by country reveals that the four biggest country markets in Europe for air travel (the UK, Spain, Germany and Italy) have all seen a year-on-year reduction in scheduled seat capacity. Greece has also seen a relatively small decline, but Austria (with Austrian Airlines downsizing), Finland (Finnair shrinking slightly and the demise of Air Finland), the Czech Republic (CSA Czech Airlines downsizing by over 40%), and Hungary (the demise of Malév) have all seen capacity reductions of at least 5%.

Source: OAG Max Online for w/c 6 August 2012 and w/c 1 August 2011

Among country markets reporting impressive double-digit growth are non-EU members Turkey and Norway, driven by the impressive growth of Turkish Airlines at its Istanbul hub (from where it serves more destinations non-stop than any other European carrier at any single airport) and Norwegian, Europe’s third biggest LCC after Ryanair and easyJet. Also performing well this summer are the joint hosts of the UEFA

Euro 2012 football tournament, Poland and Ukraine, with scheduled seat capacity up over 10% in both countries.

London and Warsaw get ‘new’ airports, Bucharest loses Baneasa

In 2012 Bucharest’s second airport (Baneasa) has closed to scheduled services, giving a big boost to the city’s primary airport at Otopeni. Meanwhile, the closing of Berlin Tegel has been delayed until at least October 2013. In Poland the opening of Modlin airport has provided Warsaw with a second airport, and London Southend has successfully re-launched itself as a commercial airport with the opening of a new passenger terminal and multiple easyJet services.