Palenzona and Bonomi believe that the common strategy objectives of AdR and SEA are best achieved by “working in a system”. Importantly, they emphasise that Rome and Milan are complementary systems that are not in competition with one another.

The two operators believe that their common strategy objectives are best achieved by “working in a system”. Importantly, both Palenzona and Bonomi emphasise that Rome and Milan are complementary airport systems that are not in competition with one another. Their complementary catchment areas are characterised by business and cargo traffic in the north of Italy and by tourism, industrial and service traffic in the centre and south of Italy; while the Milan catchment area is composed of mainly outbound business traffic, Rome is characterised by predominantly inbound tourism traffic. “We believe that our catchment areas do not overlap, but are complementary. There is room for the growth of both AdR and SEA’s large airport infrastructures and for market improvement,” said Bonomi. “The relationship between our two companies has grown and is aimed at strengthening industry and business in Italy.”

Under the capital expenditure plans, work at Milan-Malpensa will include development of a Cargo City. €1.5 billion will be invested in Malpensa and Linate between 2009 and 2020 and €4.5 billion invested at Malpensa between 2020 and 2040.

The recovery in European air traffic in Q1 2010 has been encouraging and is borne out by figures for the Rome and Milan airports; AdR, for example, recorded 7.5% growth and the effects of the ash cloud from the Icelandic volcano have been limited at Fiumicino and Ciampino. “We are now back with positive figures and profit,” commented Palenzona.

SEA reports a 9.5% increase in passenger traffic in Q1 2010 and 37% cargo growth. Bonomi explained that the recovery began in the second half of 2009 and has continued this year. While April’s figures were impacted by the volcanic ash cloud, which caused four days of paralysis at Malpensa and Linate, those for May show 10% passenger growth and 30% cargo growth. “There are good signs of recovery across the Italian airport system,” explained Bonomi. The two hubs, together, have the potential for highly competitive international leadership and it is believed that an approach centred on “teamwork” will enable AdR and SEA to compete with other airports on a European and world level. Increased competition between European airports and the emergence of the Middle East hubs means innovative strategies are required to maintain and enhance market position. Central to the AdR-SEA strategy is the recognition that these airports must continue their development to position themselves to withstand increasing international competition as the industry emerges from the economic crisis.

The development of Rome Fiumicino will see capital expenditure of €3.6 billion to 2020, with projects including a new Pier C; completion of the new Boarding Area A, which will complete the Alitalia dedicated infrastructure; a new baggage handling system; a new multi-storey car park and automated people mover, and a new runway.

New charges regime

The Italian Government implemented a new charges regime towards the end of 2009 under the so-called ‘anti-crisis decree’, covering airports handling more than 10 million passengers per year. The new charges scheme brings to an end 10 years of stagnation and paves the way for the increased competitiveness of Italy’s airports at international level. It will also facilitate the capital expenditure plans of AdR and SEA, which are so crucial to the operators’ shared objectives, as it allows airports handling more than 10 million passengers per year to enter into planning agreements directly with ENAC (the Italian Civil Aviation Authority). “It is important to note that charges in Italy are 40% lower than the European average,” said Bonomi. “The new charges regime is really a fundamental issue, as with no charges increase there would be problems filling the infrastructure gap. It is important to plan in advance and create capacity; without the charges increase, we cannot solve the issue of capacity.”

As part of the collaboration, AdR and SEA jointly presented their capital expenditure plans, totalling €5.5 billion in the period to 2020 and €13.7 billion to 2040, to the Italian Government and financial community.

The ‘new Alitalia’ marked its first birthday in January, having carried 22 million passengers in its first year of operations. At Malpensa, the ‘new Alitalia’ has an 8% market share, while at Linate, the airline dominates with two-thirds of traffic. Alitalia has also returned to AdR and accounts for a 50% market share; indeed, Terminal 3 at Fiumicino is exclusively dedicated to Alitalia services.

Palenzona explained that the new scheme will give certainty to airports in terms of the regulatory provisions and revenues necessary to attract market resources. “Resources must be obtained from the market through an adequate charges scheme capable of guaranteeing, over time, the generation of revenues required to support capital expenditure,” he said. “The enforcing procedure must envisage – in compliance with all rules – streamlined and faster authorisation processes. In fact, it is necessary to speed up the procedure as much as possible, in order to recover the delay already accumulated over the past decade. For a long time, there has been no materialisation of our ideas. It is vital that we now move from words to actions.”

New charges regime: ENAC comment

Alessio Quaranta, Director General, ENAC, explained that the new charges regime is aimed at the pre-financing of urgent infrastructure investments for those airport managing bodies that expressly request it. “The real impact of the measure will be known only at the end of the evaluation process of the urgent airport works and, however, within the limit of €3 per intra and extra-EU passenger on the basis of the boarding/landing charge,” he said. “The provisional measure of pre-financing means resources readily available for the implementation of urgent and necessary works and to ensure the operating activity and the infrastructural development of Italian airports.”

Quaranta added that the benefits for airport operators will be represented by the ability to recover, through the user charge, the costs borne by the realisation of urgent airport works. The scheme provides “the opportunity to speed up the development of airport infrastructure and facilities, improving the quality of services provided to passengers”.

Significant investment in the future

As part of the collaboration, the two airport operators have jointly presented their capital expenditure plans, totalling €5.5 billion in the period to 2020 and €13.7 billion to 2040, to the Italian Government and financial community. “We absolutely need certainty in the Italian regulatory scheme to make this possible. We want certainty based on market requirements – in terms of the market and capital expenditure plans. With the Italian Government and ENAC, we undertook the process to sign a planning agreement between the two airport operators and the authorities to develop a charges scheme in line with the investment plans. We are aware of the need for investment and need the charges scheme to recognise that,” said Bonomi.

Palenzona explained that the new Italian charges regime will give certainty to airport operating companies in terms of the regulatory provisions and revenues necessary to attract market resources. “Resources must be obtained from the market through an adequate charges scheme capable of guaranteeing, over time, the generation of revenues required to support capital expenditure,” he said.

In recognition of the need for investment, AdR’s shareholders have not taken a dividend since 2007; that money has instead been put into the operator’s capital expenditure plans. “It is important to think about the future – to think ahead,” said Palenzona. “It is important to look at the long-term horizon to 2030/2040 – to plan things and not play catch-up.” Capacity at Rome Ciampino, for example, will be increased from 25 million to 40 million passengers per year.

Bonomi: “We believe that our catchment areas do not overlap, but are complementary. There is room for the growth of both AdR and SEA’s large airport infrastructures and for market improvement. The relationship between our two companies has grown and is aimed at strengthening the industry in Italy.”

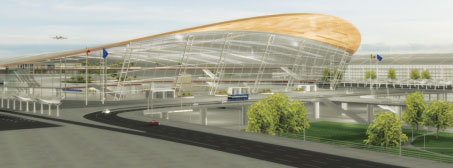

The development of Rome Fiumicino will see capital expenditure of €3.6 billion to 2020, with projects including a new Pier C; completion of the new Boarding Area A, which will complete the Alitalia dedicated infrastructure; a new baggage handling system; a new multi-storey car park and automated people mover; a new runway; and new real estate infrastructure for hospitality improvement.

There are two strands to SEA’s capital expenditure plans; the first of these, to be implemented by 2020, will see €1.5 billion invested. At Malpensa, this will involve works on Terminal 1 and construction of a third runway at the airport, alongside development of a Cargo City, while Linate’s role as the ‘city airport’ will be strengthened. The second strand will see €4.5 billion invested at Malpensa between 2020 and 2040, with a new terminal, a new integrated logistics centre and a cargo area to enable Malpensa to compete with the world’s leading commercial airports.

The investment plans of AdR and SEA are expected to create 2,500 jobs for every one million additional passengers.

In a further tangible example of its engagement with other stakeholders, it was announced in January that SEA, on behalf of both Milan-Malpensa and Milan-Linate, has achieved the ‘Optimisation’ level of Airport Carbon Accreditation. They were the first airports to accredited at the ‘Optimisation’ level, which means that in addition to reducing their own carbon emissions, the airport company has widened the scope of its carbon footprint to include third party emissions. SEA’s efforts, combined with its policy of stakeholder engagement, resulted in CO2 reductions of -7.2% at Milan-Linate and -18.7% at Milan-Malpensa (based on a rolling average between 2006 and 2009).

There are two strands to SEA’s capital expenditure plans; the first of these, to be implemented by 2020 will include works on Terminal 1 and construction of a third runway at Malpensa.

New charges regime: Bologna comment

Nazareno Ventola, planning and control director, Aeroporto G. Marconi di Bologna, described the new charges regime as significant, explaining that it will allow Italian airports to start investing again in the necessary infrastructure to sustain traffic development. “It means a lot of work to do, but at least a chance to finally be able to bridge the infrastructure gap between Italy and Europe. In recent years, the Italian airport system has invested less than one third of the European average in terms of euro per passenger,” said Ventola.

For Aeroporto G. Marconi di Bologna, it means the opportunity to sustain development and define new relationships with airlines.

A new airline model

Both AdR and SEA offer some differentiation between the facilities offered to low-cost and full-service carriers. Milan-Malpensa’s Terminal 2, for example, is dedicated to easyJet services. With 17 based aircraft, the airline handles five million passengers per year from Milan-Malpensa.

Both AdR and SEA’s airports offer some differentiation between the facilities offered to low-cost and full-service carriers. Milan-Malpensa’s Terminal 2, for example, is dedicated to easyJet services. The airline has 17 aircraft based there and handles five million passengers per year from the airport, which makes Malpensa the biggest easyJet base in continental Europe. “The economic crisis has emphasised the fact that demand in air traffic has changed – there is a clear distinction between low-cost and traditional carriers,” explained Bonomi. “Low-cost carriers are traditionally for short-haul and full-service carriers for long-haul traffic.” Rome’s Ciampino Airport is, likewise, dedicated to low-cost carriers.

Bonomi and Palenzona share the view that the traditional airlines should reflect on a new business model as low-cost carriers acquire an increasing market share. “A new model will be considered. I see an integration between the low-cost and traditional models – there are synergies,” said Bonomi.

Palenzona added “I agree with Mr Bonomi’s analysis of the market. We want airlines to have good results and are happy when they do so. The regulators should not allow unfair competition – no State aid for low-cost carriers. The market needs transparency.”

New charges regime: Trieste comment

Paolo Stradi, general manager, Trieste Airport, explained that any increase in charges will be added to the passenger boarding fee, if authorised by ENAC, following positive evaluation of the airport’s investment plans. “We hope that airport operators will have the opportunity to start implementing those infrastructure investments that cannot be postponed any longer. I think that, the previous charges scheme having been in place for 10 years, this scheme will be very welcome and beneficial for airport operators, especially larger ones,” he said. “I think that the main benefit, besides a mere financial benefit, might be a sort of kick-off for getting out of a static situation that has been going on for too long.”

The ‘new Alitalia’ marked its first birthday in January, having carried 22 million passengers in its first year of operations. There is a clear distinction to be made between its presence at the Milan and Rome airports. At Malpensa, the ‘new Alitalia’ has just an 8% market share, with easyJet and the Star Alliance carriers having the greatest market share. Conversely, at Linate, Alitalia dominates with two-thirds of traffic. “Relations with Alitalia are good – we know their strategy in the short-term. We advocate that Alitalia can go on and compete in the market. The start-up phase of the new Alitalia was complicated, as this occurred during a period of economic crisis, however, the Alitalia product has improved in terms of quality,” said Bonomi.

Alitalia has also returned to AdR and accounts for a 50% market share; indeed, Terminal 3 at Fiumicino is exclusively dedicated to Alitalia services. “As an airport operator and Italian citizen, I’m really happy about the new Alitalia being back on the market. We’re optimistic and want to collaborate with all airlines, especially Alitalia,” commented Palenzona.

The visionary AdR-SEA collaboration places the airport operators in a strengthened position to capitalise on increasing traffic volumes to and from Italy as the industry emerges from the financial crisis. The new charges regime, put in place after 10 years in which charges were unchanged, will also facilitate significant capital expenditure and enable AdR and SEA to retain market position.

The first module of Rome Fiumicino’s new North Terminal is scheduled to be operational in 2020 and will double capacity to 100 million.