Three airports reported traffic growth of over 40% in August, led by Allgäu-Memmingen (located west of Munich) which has seen passenger numbers more than double thanks to low-cost carriers such as Ryanair, TUIfly and Wizz Air.

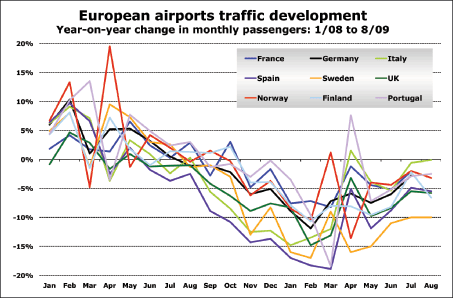

While nobody is pretending that the economic difficulties affecting air travel demand across Europe have disappeared, there is clear evidence to suggest that the worst would appear to be over and that traffic declines have bottomed out. Analysis by anna.aero has revealed that over 50 airports across Europe have reported year-on-year traffic growth in August. However, while this number is likely to rise in the coming months it should be remembered that this time last year traffic demand was already beginning to weaken and that a more useful measure for airports might be to compare traffic in the remaining months of this year with demand levels in 2007.

SAS’s problems having major impact in Sweden

Source: IATA

Of nine major European countries for which data is readily available none have reported overall growth in any of the last four months, although Italy came close in August. However, only Sweden is still reporting a double-digit reduction in passenger numbers, driven by the difficulties being experienced by SAS and the lack of a major home-grown competitor. However, even in Sweden exceptions to the trend can be found and Stockholm Skavsta has reported traffic growth in each of the last five months.

The curious peaks in March (Norway) and April (Portugal) can be explained by the re-timing of Easter back into April this year. This helped Portugal’s leisure dominated air traffic grow in April (after a noticeable dip in April 2008) while Norway’s business dominated air traffic grew in March (after falling in March 2008) benefiting from the lack of Easter.

Fortunately there have been no major airline failures across Europe, with the most notable closures so far in 2009 being flyLAL (of Lithuania), MyAir.com (of Italy) and SkyEurope (of Slovakia).

Airport winners…

In August three airports reported traffic growth of over 40% led by the relatively new airport at Allgäu-Memmingen (located west of Munich) which has seen passenger numbers more than double thanks to low-cost carriers such as Ryanair, TUIfly and Wizz Air. Trapani (+89%) and Brussels Charleroi (+43%) have also benefited significantly from Ryanair’s presence and ability to stimulate traffic in new markets.

…and losers

Among airports which have seen passenger numbers fall by over 20% in August are Forli (which has lost out to nearby Bologna as some airlines have relocated), London City (which had grown by 12% in 2008), Tallinn, Glasgow Prestwick (a Ryanair base that has seen traffic fall as the airline has developed a base at Edinburgh) and Vilnius (severely impacted by the demise of flyLAL.

Mixed messages from airlines regarding this winter

According to IATA statistics for July, international traffic by European carriers was down just 3% and load factors were even up slightly. However, most of the major European legacy carriers are not planning capacity growth this winter. Air France recently announced a 1.7% capacity cut for winter 2009/2010, while KLM will reduce its capacity by 4%. However, despite plans to cut the number of aircraft based in the UK and Ireland, Ryanair is still likely to report double-digit growth thanks to allocating additional aircraft across mainland Europe.

easyJet too has decided to cut UK capacity but also plans to maintain growth at 7.5% in the medium term by reassigning aircraft to continental bases. Overall it seems likely that airport traffic across Europe this winter will be broadly comparable with that experienced last year, though there will be regional and local variations.